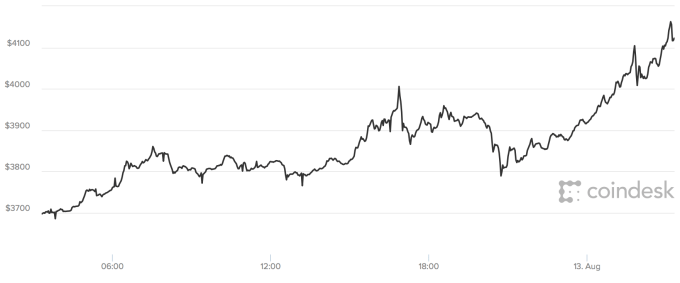

What a day for Bitcoin.

24 hours ago the cryptocurrency was trading below $3,700. About an hour ago it surged passed $4,000 and has no signs of stopping. It’s now trading around $4,135.00. For reference, a week ago Bitcoin hit an all-time high as it passed $3,000 for the first time.

Check out the chart below to see what the price has done in the last 24 hours.

So the million dollar bitcoin question is…why now?

Without wasting too much of your Saturday night with detailed analysis, here are a few possible reasons you can tell your friends during brunch tomorrow.

Two weeks ago Bitcoin went through a hard fork, and came out essentially unscathed. Sure, a bitcoin-clone called Bitcoin Cash was created, but it’s gotten a lot less attention than most people expected. A few days later Bitcoin locked in SegWit, a code modification that fixes malleability issues and frees up space in blocks, allowing for more transactions to be stored in each one.

These two code-related developments have helped boost conference in Bitcoin’s future.

Another reason – the ICO frenzy. The amount recently raised via initial coin offerings have now (at least temporally) topped amount raised via early stage venture capital. Just last week Filecoin raised $180 million in a few hours. Most investors have to convert fiat currency to bitcoin or other cryptocurrencies to participate in ICOs, which could be driving up the price (and providing some investors with their first taste of bitcoin).

Another reason – Wall Street’s new obsession is bitcoin. You can’t watch CNBC for five minutes without seeing a trader or analyst give their opinion – which is usually something insanely bullish like “it’s going to be the best performing investment of the year”. For better or for worse, statements like these are getting non-technically inclined investors interested in bitcoin, some of which are definitely buying coins for the first time.

So what happens next? No one knows. Bitcoin could crash 50% to $2,000 tomorrow or spike to $5,000 – and I don’t think anyone who truly knows crypto would be surprised at either option. E

veryone has a different opinion – some say the bubble is oversized and should have popped months ago – others think that bitcoin is currently just a fraction of what it could eventually trade at.

Whichever camp you fall in, here’s one friendly reminder: don’t invest more than you can afford to lose – because if you ask anyone who’s spent more than a few months in the cryptocurrency world they’ll tell you it’s a roller coaster.

More@ https://www.technapping.com

Source: Techcrunch

Comments

Post a Comment